Understanding Auction Guarantees and Irrevocable Bids through Rothko’s ‘Yellow and Blue’ Sale

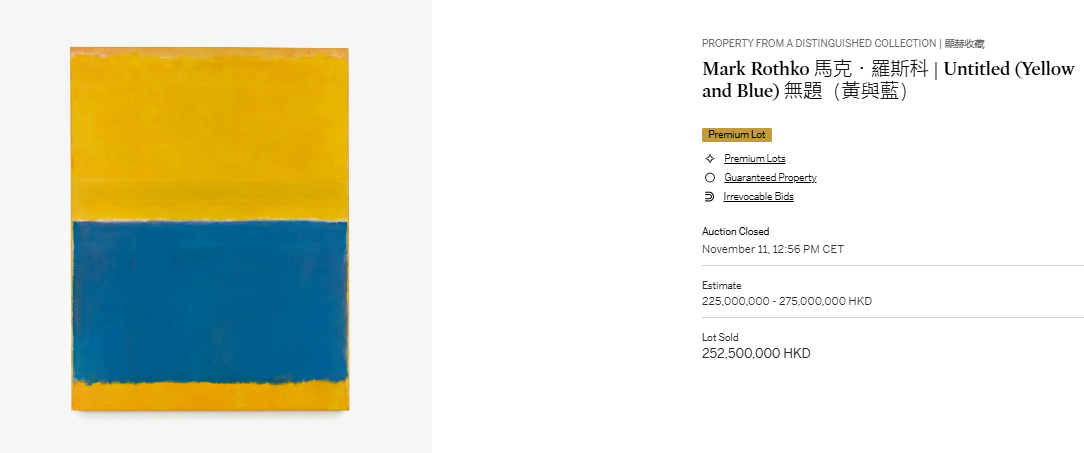

The top lot at Sotheby’s recent Hong Kong auction was Mark Rothko’s Untitled (Yellow and Blue), which sold for HK$252.5 million ($32.5 million USD), within its estimate of HK$225–275 million. This nearly 8-foot-tall painting from 1954 has changed hands among prominent owners, from U.S. banker Paul Mellon to French luxury executive François Pinault, before it was purchased by the controversial financier Jho Low. Originally sold in 2015 for $46.5 million, Untitled (Yellow and Blue) returned to the auction block at a softer price, underscoring today’s market dynamics.

To ensure a successful sale despite these market conditions, Sotheby’s arranged both a Guarantee and an Irrevocable bid on the lot, a strategic move that secured a sale regardless of bidding activity - or lack of - in the sale room. The winning bid, arranged by Patti Wong & Associates for a private collector, came down to a competitive finish between two phone bidders.

But what exactly do “guarantee” and “irrevocable bid” mean? While common in high-profile auctions, the mechanics behind these arrangements often remain unclear. Here’s a closer look at how each one works and how they played a role in Rothko’s sale.

Guaranteed Property

A guaranteed property is an arrangement in which an auction house commits to a minimum sale price for a consigned artwork, providing the seller with financial assurance regardless of the level of bidding activity in the auction. This guarantee is a powerful incentive for sellers, as it reduces the risk of their work selling below a certain price or going unsold, even if bidding activity is limited. By offering this type of financial security, the auction house attracts valuable consignments that might otherwise hesitate to go to auction.

How It Works:

The auction house guarantees the seller a minimum price, which may apply across one or more auctions if multiple lots are included in the consignment. To manage its own risk, the auction house often ‘offloads’ or passes on the risk of this commitment to a third-party guarantor, who agrees to place an irrevocable bid for the lot. While each arrangement varies, the auction house typically aims to match the guarantee amount with the irrevocable bid, securing the seller’s minimum price without exposing itself to financial risk.

For example, Sotheby’s frequently uses this approach for high-profile consignments, where a guarantee may extend across several auctions to secure a minimum return for the entire consignment, underscoring the auction house’s commitment to a successful sale outcome.

Irrevocable Bids

An irrevocable bid is a commitment from a third-party bidder to place a pre-set bid before the auction begins. This guarantees that there will be at least one serious bid on the lot, establishing a strong starting bid and encouraging further interest from other buyers. For the seller, this arrangement provides a minimum level of assurance that the work will sell.

How It Works:

The third party agrees to bid at a set price, guaranteeing that the lot has at least one committed bid from the outset. This commitment secures the sale by giving the seller a reliable starting bid, which can stimulate further bidding and competition.

Compensation if Outbid:

If bidding exceeds the irrevocable bid, the irrevocable bidder may (though not obligated) continue bidding on the lot. Regardless of whether they continue to bid, the irrevocable bidder will be entitled to receives compensation for their commitment. This may take various forms, including:

A financing fee: a fixed percentage of the hammer price

A pre-agreed share of any overage, i.e. the difference between the irrevocable bid amount and the hammer price, or

A combination of both

This structure offers the seller a secure opening bid while giving the irrevocable bidder the option to continue participating. The financial incentives apply even if the irrevocable bidder remains active in bidding, providing them with flexibility and the potential for a financial return as the auction progresses.

Rothko’s Untitled (Yellow and Blue) - Courtesy of Sotheby’s

Key Takeaway: There’s more than meets the eye

In major art auctions, financial tools like guarantees and irrevocable bids are powerful strategies that auction houses use to attract valuable consignments—often competing for these high-profile works—and to enhance their public standing. These arrangements assure sellers of a minimum sale price and help generate excitement in the auction room, yet there’s more behind these deals than meets the eye.

While the presence of guarantees and irrevocable bids is widely known, the specific terms of each arrangement—between the auction house, the consignor, and the irrevocable bidder—are closely guarded secrets. This confidentiality allows the auction house to shape each deal privately, managing expectations and crafting a polished image of success for the public.